Countdown295Days

State Grid Corporation of China

Ministry of Commerce of the People's Republic of China

China Electrical Equipment Management Association

Shanghai Metrology Association

Zhejiang Provincial Electric Power Industry Association

Shanghai Electric Power Industry Association

Jiang Su Electric Power Association

Shanghai Golden Conference & Exhibition Group Co., Ltd.

Shanghai Public Welfare Metrology Notary office

State Grid Corporation of China

Speaking of power utilities, what people in the Chinese industry usually think of are, often time, the two “grid companies”: China State Grid (SGCC) and China Southern Power Grid (CSG).

The power generation companies, or power gencos, are often not on the top of people’s minds. Whereas in many other counties—such as in various European countries—power utilities usually refer to the generation and power trading groups, to name a few: E.on of Germany, EDF of France, Iberdrola, and many others.

The apparent difference underlines some key feature of the Chinese power market, in which the grid companies are much more dominant players. This structure comes from a power market reform in 2002 when the former vertically integrated player State Power Corp of China (SPCC 国家电力总公司) was decoupled and five generation firms and two grid companies were created. Since then, the grid companies, however, control not only the grids’ system operation (the dispatch order) but they also used to serve as the sole power trader in their geographically separated markets. Neither the generation companies nor the grids decide power prices. Instead, they follow prices set by Beijing and the local government, but they could influence price decisions. But the combined role of grid companies in TSO and trading provides them higher leverage on the policy decision and on market.

The power generation utilities, in this setup, have less market influencing power, as they do not really connect to the retail market. The setup has been gradually changing since in 2016, as the power retail market is finally open up to non-grid traders. But China’s trading reform still has a long way to go, and the rooted conflict of interest remains to be solved. It is highly uncertain whether the generation companies could improve their position in the market via the reform.

Fill out a short survey to help us understand how we can bring move value to you and your business

That being said, make no mistake, the power generation companies—especially the state-owned players—are no way minor figures. The tier-one utilities, especially, are all world-leading players in terms of their installation size and asset size. Since the merger between China Guodian and Shenhua took place two years ago, the new China Energy Investment Group has exceeded EDF as the largest power utility in the world in terms of installed power capacity. State Power Investment Corp (SPIC) is the largest renewable power producer in the world in terms of the combined wind and solar capacity. And even some of the tier-2 players such as China General Nuclear, China Three Gorges, are also the frontrunners in their sub-sectors—in nuclear power and hydropower, in the two cases.

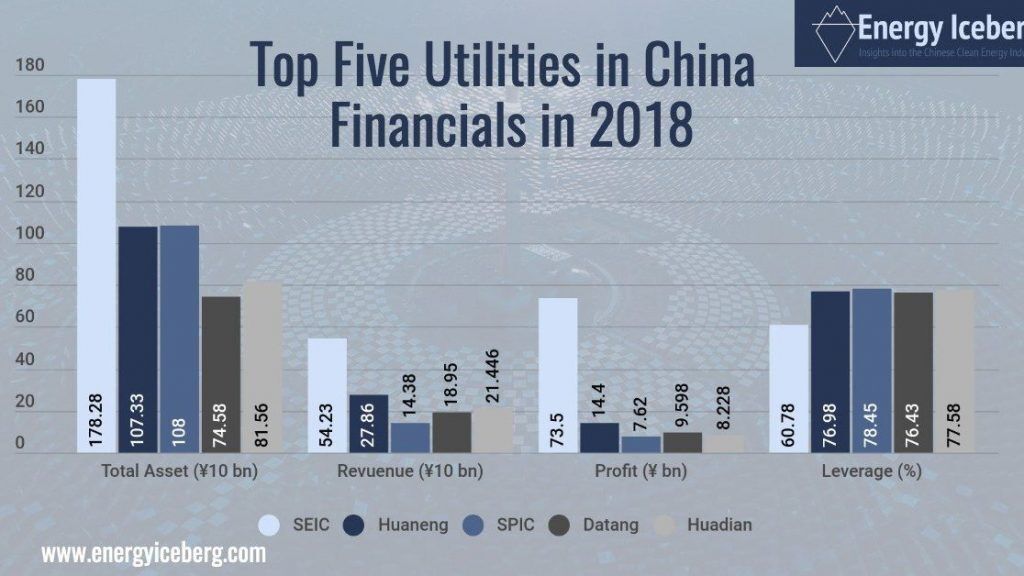

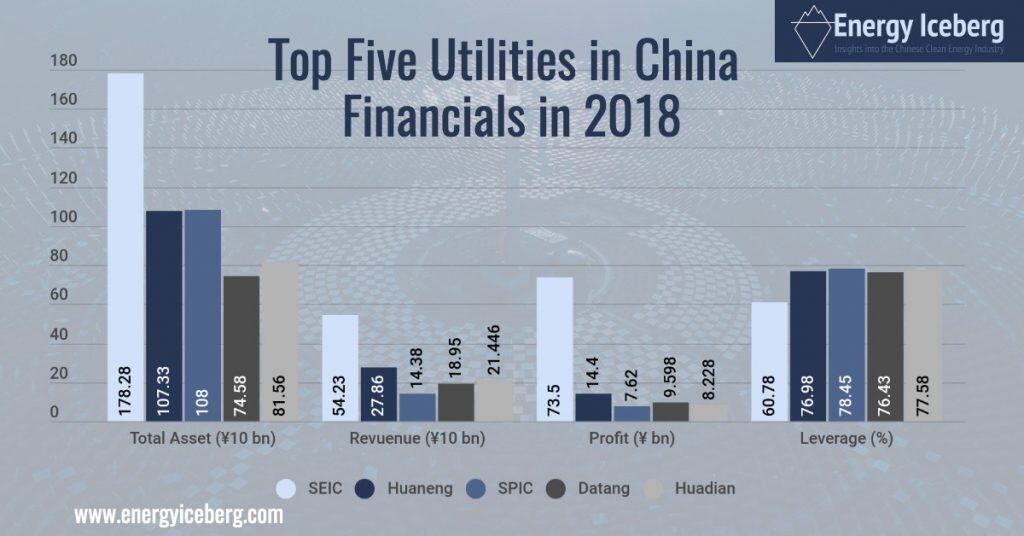

Financials in 2018

Financials in 2018

So who are the state-owned power generators in China? What do you need to know about them? There are, in fact, a sea of different power developers in the Chinese power market. But, typically, they can be categorized into the following groups:

Firstly, five central-government owned tier-one players who have developed a well-rounded power portfolio covering coal, hydro, wind, solar, and nuclear.

Secondly, the tier-two government-run companies with smaller size but more tailored strategy. Then, there are regional power players owned usually by local authorities. Besides these three, there are still various IPPs, foreign companies, PPP, and many other possibilities.

The “Big Five”: the five largest power utilities in China in terms of asset size, installed capacity, as well as their leverage on policymaking. The “Big 5” was born around China’s 2002 power market reform when at that point the State Power Corp (a state-owned company based on previously the Ministry of Electricity) was unbundled into five generation companies—as well as two grids and four engineering firms.

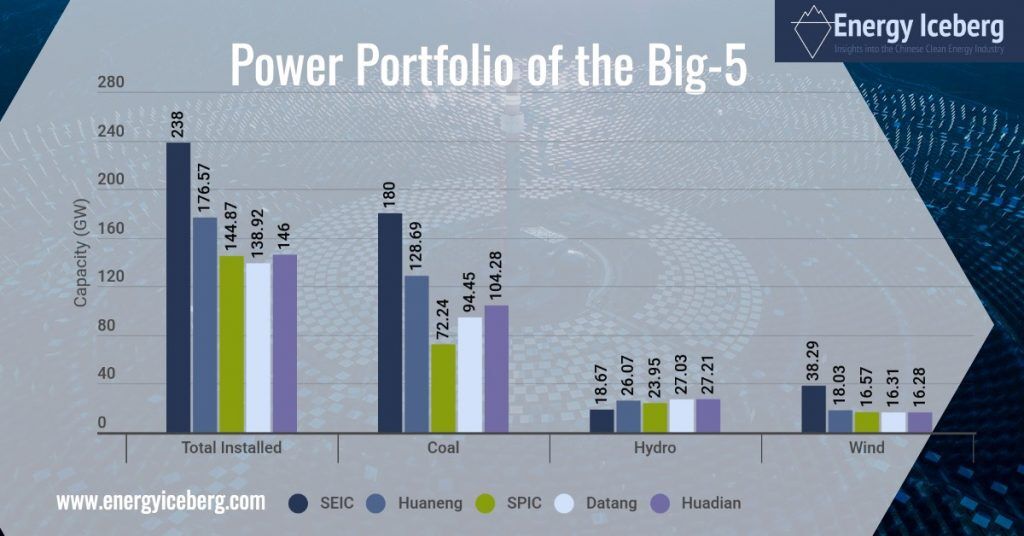

The initial 5 were China Huaneng, China Huadian, China Power Investment (CPI), China Guodian, and China Datang. They inherited varied generation assets from the State Power Corp, with slightly different strategies at first. e.g., Guodian was known to be “good at wind power” owing to its inheriting Longyuan Corp—one of the first wind power developer in China.

All five are, essentially, owned by China’s central government— State Asset Supervision and Administration Commission (Sasac). Rumor has it that the former head of Sasac set down a plan to encourage the five to compete—so the strongest to survive. This plan, however, spurred the five to take an aggressive approach to expand in their power portfolio in highly identical directions. As a result, all of them are massive players in coal, hydro, wind, and solar; all of them own some coal mining asset; most of them own coal transportation facility (rails); all want to develop nuclear, but so far only one is a legit nuclear developer, and two are getting closer to success.

The initial-5 have changed now, after a period of state-owned asset restructuring in 2017-2018. Simply put, the former CPI consolidated a key nuclear player, the State Nuclear Power Technology Corporation (SNPTC), and became the State Power Investment Corporation (SPIC). Similarly, the former China Guodian was acquired by a key coal mining company China Shenhua to form the China Energy Investment Corporation (CEIC), overtaking Huaneng as the largest of the five in terms of asset size. In the long run, restructuring between the five and other energy companies is still likely to occur.

Together, the Big 5 own 45% of Chinese energy generation assets. My comments on them:

CEIC: largest wind developer as it owns Longyuan; largest coal miner due to the asset of Shenhua; currently the largest but face the uncertainty of creating synergy

SPIC: with the most abundant renewable capacity, the only “licensed” nuclear developer of the five; the chosen company to conduct state-owned enterprise’s management reform; very active in building several world-class projects (hybrid renewable, CAP1400); a key contester in offshore wind

Huaneng: used to be the largest of the initial-5, known for its IGCC technology and portfolio; aiming to squeeze into the nuclear industry (HTGR developer)

Huadian: more active than others in natural gas; owned overseas shale gas and LNG portfolio—but gas power is still a challenging business in China

Datang: struggling right now due to heavy burden from the lesser efficient coal power assets; took a “wrong” strategy to develop coal-to-chemical (coal-to-gas) but failed due to Beijing’s U-turn on the industry

Power Portfolio of China’s 5 Largest Power Utilities

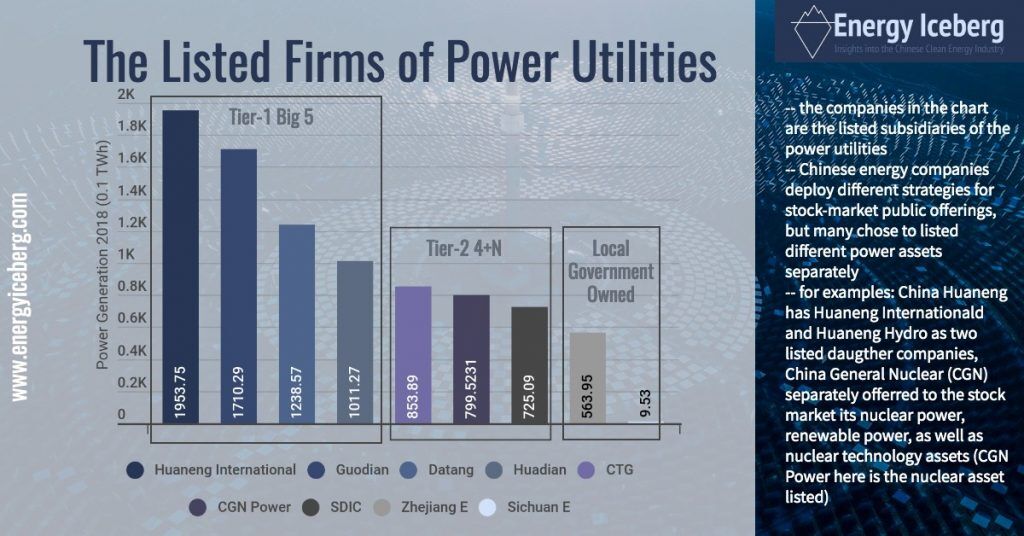

The “4+N”: there are 4+N power companies that are, still, central government-owned power utilities. They are smaller in size compared to the big-5 and grew independently from the former State Power Group.

Referred to as the “Small Noble 4,” they are China General Nuclear (CGN), Sate Development and Investment Company (SDIC), China Resources, and Guohua Power of Shenhua Group (now part of China Energy Investment Corp after Shenhua and Guodian’s merger in 2017). Their “nobleness” points to their background (e.g.CGN as the largest nuclear developer in China, Shenhua, the biggest miner), but also relates to the better financial performance of their power asset—notably newer in technology, and more efficient in terms of management.

But there are certainly more Beijing-controlled power companies that can be categorized in this club—especially China Three Gorges (CTG) and China Energy Conservation & Environmental Protection Corp (CECEP).

The “Small 4” together still control about 10% of China’s installed energy capacity. The “Small Nobel” generally have a stronger interest in the clean power sectors. Their strategies right now:

CGN: nuclear remains its core strength, but wind is its second major business (5th wind developer in China) with the offshore wind a current priority; CGN was also active in small-hydro development and LNG infrastructure construction

CTG: the company is known for its stable cash flow for the Three Gorge Dam, providing them leverage to invest in renewable; the firm looks to develop offshore wind as its second main business

Guohua: a coal power producer but also interested in offshore wind

Read More on the “Deleveraging” Challenges Facing Chinese Utilities